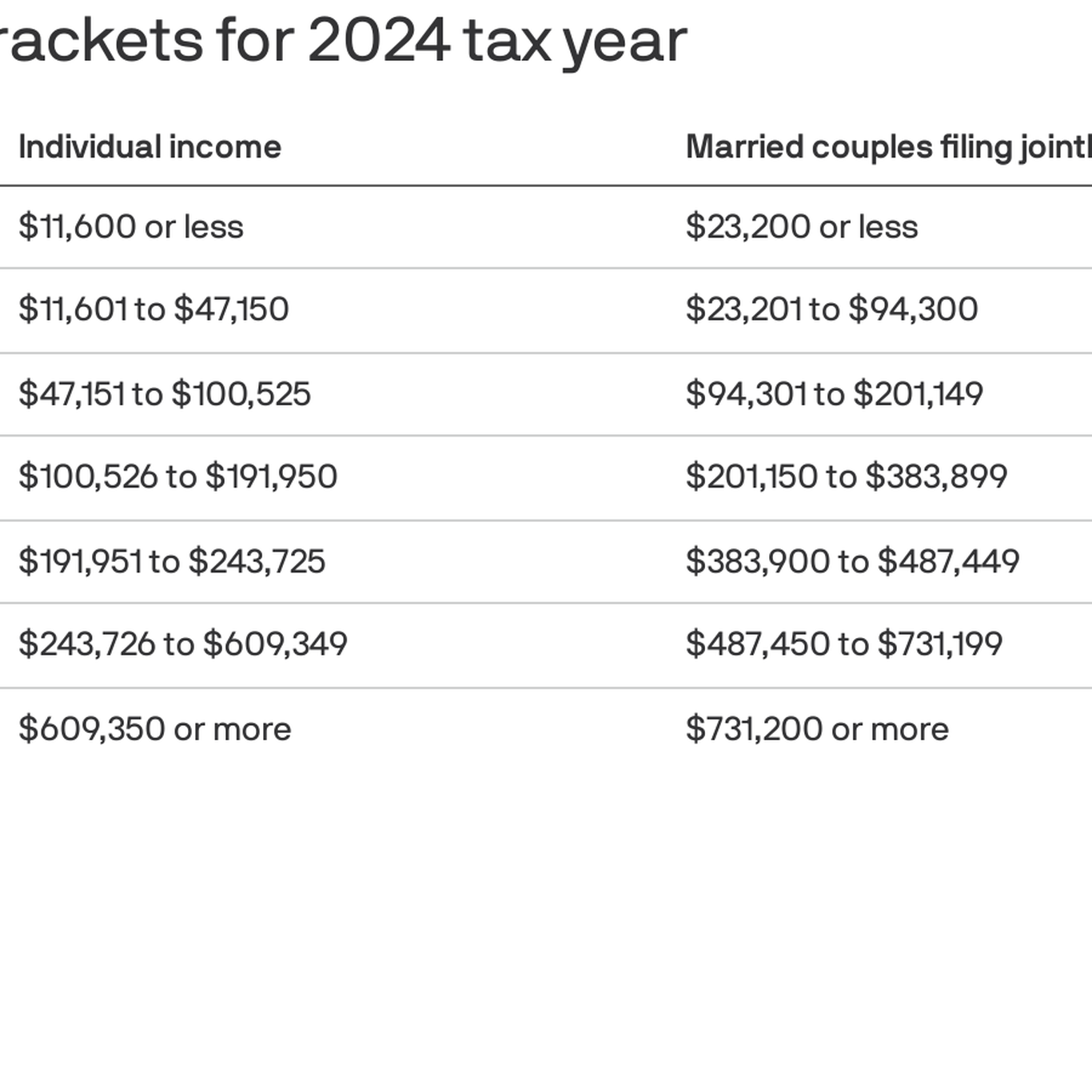

Tax Brackets 2024-2025 Irs – For 2024, the lowest rate of 10% will apply to individual with taxable income up to $11,600 and joint filers up to $23,200. The top rate of 37% will apply to individuals making above $609,350 and . The higher amounts will apply to your 2024 taxes, which you’ll file in 2025. It’s normal for the IRS to make tax code changes each year to account for inflation. This also helps prevent “tax bracket .

Tax Brackets 2024-2025 Irs

Source : www.cnbc.com

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

2024 tax brackets: IRS inflation adjustments to boost paychecks

Source : www.axios.com

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

IRS announced new tax brackets for 2024—here’s what to know

Source : www.cnbc.com

2024 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Source : taxfoundation.org

IRS raises tax brackets, see new standard deductions for 2024

Source : www.usatoday.com

Tax Foundation on X: “The IRS released its new inflation adjusted

Source : twitter.com

Projected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.com

Tax relief is on the horizon! ????✨ Say goodbye to higher tax rates

Source : www.instagram.com

Tax Brackets 2024-2025 Irs IRS: Here are the new income tax brackets for 2024: The Internal Revenue Service’s new federal income tax brackets and standard deductions took effect Monday, providing a boost to many people via slightly higher, inflation-adjusted paychecks. . New inflation-adjusted tax brackets go into effect for the 2024 tax season, says the Wall Street Journal’s Ashlea Ebeling. .